Whether you’re a cat person, a dog person or something in between you may be impacted by the “pet restrictions” that are part of your next home purchase. When pet policies are part of a home’s or condo’s rules they can affect both your personal uses and investment potential.

For instance, in the Seattle market, I heard an interesting statistic that more home owners have pets than children (more…)

Seattle City Council has just adopted an updated plan for row-homes, townhomes, and cottages. The first decade of the millennium was full of new construction and a majority of designs in Seattle were the townhomes.

I don’t want to give you the wrong idea; I do not have anything against (more…)

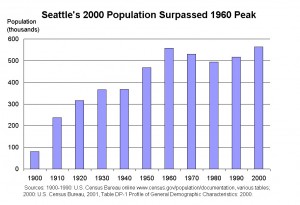

During this holiday season, it’s not just our waist lines that are experiencing growth. Washington is expected to receive another Congressional seat in the US House, all thanks to the population growth in Washington state. More specifically, the boom in the Seattle area is on the rise. (more…)

It’s official: FHA was just given authority to change the amount charged to borrowers for both the Up Front and the Annual Mortgage Insurance premiums…and change them they did.

When you are in the market to buy a condo there are some thing you need to know about Home Owners Associations (HOA). The HOA is responsible for building amenities, maintenance and, in some cases, utilities. As an owner, you may have some voting rights for the management of the budget, but the majority has the final say. I like to make sure that my homebuyers review the building’s finances to know whether or not the HOA is financially strong or as useless as a Deutsche mark.

This spring I handed house keys to a first time buyer who’d been dreaming of owning his own home for over ten years. In fact he’d been (more…)

When you get approved for a home mortgage you should ask, “What are my closing costs?” You should see them in writing. Interest rates are important, but your ‘closing costs’ are equally important. If you have a rate of 5% on a $300,000 loan with closing costs of $9000 quoted from one bank and you have a rate of 5.5% with 0 closing costs from another bank which is better? (more…)

When working with a homebuyer, I don’t start off by asking, “How much are you approved for buying?” The better question is, “How much of a payment is comfortable for you?” Typically, a homebuyer is pre-approved for an amount that is more than what they are willing to pay monthly. (more…)

When a homebuyer is purchasing a residential property, the seller is required to provide them with a Seller’s Disclosure Statement to detail any pre-existing conditions. Now, the million dollar question is whether or not everything in the disclosure statement is 100% true. Is it fact or fiction?

Consider that the homeowner is (more…)

FHA has been sustaining first time homebuyer market and lower price point homes through the collapse of the real estate market. Now that the market is slowly on its way to recovery, FHA is not so subtly backing away from their low down payment options, making it harder for a lot of homebuyers to buy their first home. (more…)